This is the last of four Frith Resource Management blogs on the UK ETS. The first introduced and explains the ETS-EfW scheme, the second reviews the current DESNZ consultation, the third discusses fossil carbon and this one identifies ETS-EfW Allowance costs, their avoidance and mitigation, and looks at the future of ETS-EfW under net zero obligations.

ETS -EfW Allowance cost

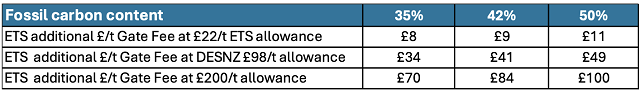

The fossil carbon content in Municipal Solid Waste and Household Waste is variable and different figures are being used to calculate the potential ETS-EfW pass through costs to Local Authorities. Applying the estimated composition of a London borough’s residual waste, for every tonne of residual waste, FRM has calculated c.0.35 tonnes of fossil carbon (as CO2eq) is expected to be emitted from the combustion process. ReLondon is using a figure of 0.42t fossil carbon per tonne of residual waste and Greater Manchester – 50:50 fossil-biogenic carbon https://democracy.greatermanchester-ca.gov.uk/mgConvert2PDF.aspx?ID=30470

The UK ETS is a “cap and trade” system rather than a tax, and the price of Allowances will depend on buying and selling within the market. The UK “reserve” price is set at £22 per tonne of carbon (UK Emissions Trading Scheme markets - GOV.UK (www.gov.uk) but prices could be higher on the secondary market, particularly as the number of Allowances reduces year on year. The price of emissions Allowances traded on the European Union’s Emissions Trading Scheme (ETS) reached a record high of €100.34 per tonne of CO₂ in February 2023 (EU-ETS price 2022-2024 | Statista) Average spot prices have increased significantly since the 2018 reform of the EU-ETS, and up to £200/t have been suggested by some commentators. The DESNZ ETS modelling is based on prices of £98/t in 2028 (Traded carbon values used for modelling purposes, 2023 - GOV.UK (www.gov.uk)) in the “Net Zero Strategy aligned” central scenario. The additional Gate Fee cost per tonne residual waste for the above fossil content and ETS-EfW Allowance prices is:

In addition to this ETS-EfW Allowance cost, EfW facility operators will have a monitoring, reporting and verification cost (MRV). This will vary depending on the size of the EfW facility.

ETS-EfW cost avoidance and mitigation

Ultimately, some of these costs will be passed onto the waste producer. The costs at the higher end of the ETS Allowance price are substantial. However, whilst the majority of the fossil carbon emissions are from plastics and cartons should be covered by pEPR (packaging Extended Producer Responsibility), so in theory there could be a much lower net cost to the Local Authority. There will however be some emissions that do not come under pEPR e.g. textiles, some WEEE, some furniture, elements of absorbant hygiene products, plastic non packaging items (e.g toys). In addition the DRS obligated materials don’t fall under EPR in the period prior the implementation of DRS (the date of which is still a bit uncertain!), so there is an obvious gap here for single use plastic drinks bottles. There is a need for Government to address these additional burdens to prevent it falling onto the local authorities and local taxpayers.

Reducing the fossil carbon content of residual waste through increased recycling, reuse and waste prevention should lower the ETS cost, subject to the approach to measurement and allocation of ETS obligations. Local Authorities whose residual waste is combusted are unclear as to what their pEPR income will be and their ETS-EfW Allowance costs post 2027. There are substantial revenue streams and cost liabilities involved. There is the potential for fossil carbon waste leakages and ETS-EfW Allowance avoidance through landfill, Refuse Derived Fuel (RDF) export, and waste to fuel combustion technologies. DESNZ is seeking to make these options less attractive through financial measures. Landfll Tax is to increase to £126.15/t from 2025/26 and will be monitored (Landfill Tax is set on the fiscal year whereas ETS EfW is set on calendar year. This should be aligned. RDF exported to Europe will come under the EU-ETS Allowance scheme and some import taxes. Allowances under the EU-ETS scheme are not financially linked to the UK-ETS prices and will represent a gate fee risk. MBT (Mechanical Biological Treatment) facilities with recycling and RDF outputs should be higher up the Waste Hierarchy than EfW facilities. However, unless they remove fossil carbon wastes (primarily plastics), then the MBT process will have very similar ETS costs to EfW. The MBT process could have greater total carbon emissions than EfW processes in some instances due to greater transportation and processing carbon usage. It should be noted that reducing the mass of residual waste via MBT is unlikely to affect any fossil carbon emissions in practice as moisture loss and degradation of biogenic carbon are the elements affected by biodrying / composting (not plastics / fossil derived components).

ETS-EfW Allowances may be avoided by CCUS (Carbon, Capture, Utilisation and Storage). EfW Asset owners are implementing CCS works. For example, Cory Belvedere phase 2 EfW facility has planning permission to install carbon capture technology (https://www.corygroup.co.uk/future-growth/carbon-capture-storage-project/) which will aim to capture c 1.4 million tonnes of carbon dioxide (CO2) per year by 2030. Liquified CO2 captured at the facility will be shipped to the Port of Immingham and piped and permanently stored in the Viking depleted gas fields, just off the Humber coast.

The Protos Energy Recovery Facility (ERF), a plant being developed as a joint venture between Encyclis and Biffa, near Ellesmere Port in Cheshire (https://www.protoserf.co.uk/about-the-facility/) are progressing with CCS under Government’s carbon capture cluster sequencing programme. The proposed CCS plant will capture upwards of 380,000 tonnes of CO2 per year, utilising the planned HyNet pipeline that will transport CO2 for storage in depleted gas fields in Liverpool Bay. CCUS is also planned for the Parc Adfer site in North Wales (enfinium announces plans to deliver 1.2 million tonnes of carbon removals across the UK). The ETS-EfW Allowance may be offset by district heating systems/EfW heat usage. Emissions from fossil carbon that is combusted to generate heat may be offset by heat utilised from relevant EfW facilities linked to heat networks. This will make district heating systems more attractive. It will be interesting to see how ETS-EfW Allowances are accounted for existing facilities with district heating systems e.g. Nottingham, Sheffield, Coventry; and those with industrial heat recovery e.g. Grimsby.

There is also the potential for small EfW facilities <25,000tpa to become more viable as these may avoid the ETS.

The future and net zero

The UK and EU are looking to expand their respective market-based emissions trading schemes in order to align emission reduction targets with the global climate change goals of the Paris Agreement, as reported in the CIWM Circular 25th June 2024 (Zero Waste Europe calls for waste incinerations to be included in EU ETS (circularonline.co.uk))

This reported municipal waste incineration must “immediately and comprehensively” be included in the EU’s Emission Trading System, the environmental network Zero Waste Europe. Zero Waste Europe’s (ZWE) new report “Incineration in the EU-ETS: A set of suggestions for its inclusion” calls for electricity and heat to be included in the ETS obligation, as well as biogenic CO2 facilities to be included in the EU’s Emissions Trading System (ETS). This would represent a significant shift in approach and impact. (https://zerowasteeurope.eu/wp-content/uploads/2023/04/ZWE_Jun24_Study_Incineration-in-the-EU-emissions-trading-syste-a-set-of-suggestions-for-its-inclusion.pdf).

As clarity emerges post the current Government consultation, Frith Resource Management will keep you updated, and parts 1, 2 and 3 of this series of blogs provide further insight into the ETS implications for Local Authorities.

Frith Resource Management provides technical support to local authorities and the private sector on collection, treatment and disposal issues, for details see www.frithrm.com, call 01746 552423 or email info@frithrm.com.